An Unbiased View of Medicare Part C Eligibility

A Biased View of Medicare Part C Eligibility

Table of ContentsBoomer Benefits Reviews Can Be Fun For Everyone9 Simple Techniques For Medigap Cost Comparison ChartThe Ultimate Guide To Boomer Benefits ReviewsThe Definitive Guide for Aarp Plan G

Use Method B for revenue and assets. Keep in mind: If people who are likewise qualified for MA fulfill more than one basis of eligibility, they might choose the most advantageous basis for MA, however should make use of an Approach B basis for the Medicare Cost Savings Program. Asset Standards Property restriction is: l $10,000 for a home of one.

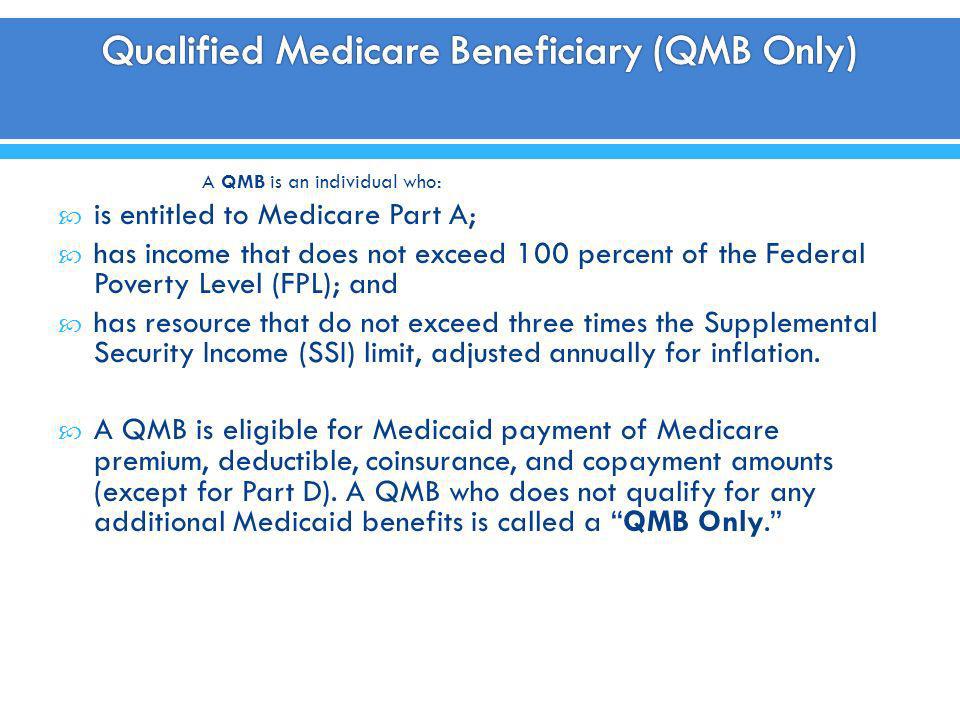

Instance: Bud's income is 125% FPG. He is disqualified for QMB also if he has covered expenditures that would enable him to invest to 100% FPG. Covered Services (Prepaid MHCP Handbook) The advantages of the QMB program are: l Settlement of Medicare Part An and also Part B costs. l Settlement of Medicare cost-sharing (co-payments as well as deductibles) for Medicare solutions provided by Medicare-eligible companies.

It is seldom advantageous for people in LTC to be QMB-only because: l Medicare Component A covers really limited skilled nursing care. l Settlement might not be verified till several months after the care is obtained. Nonetheless, if you know Medicare Part A is covering any one of the LTCF expenses, it is advantageous for people to be QMB-only because there wouldn't be an LTC spenddown.

The Facts About Medicare Part G Revealed

Individuals may get MA as well as QMB concurrently. l Individuals with earnings at or under 100% FPG certify for QMB, and additionally for MA without a spenddown if their possessions are within MA limits. l Due to the fact that QMB allows a conventional $20 earnings negligence as well as MA does not, individuals with earnings over 100% FPG yet no even more than 100% FPG + $20 are within the QMB income limitation yet should fulfill a spenddown to get MA.

Action: Because Blanche's possessions are within the QMB restriction yet not the MA limit, approve her for QMB only.

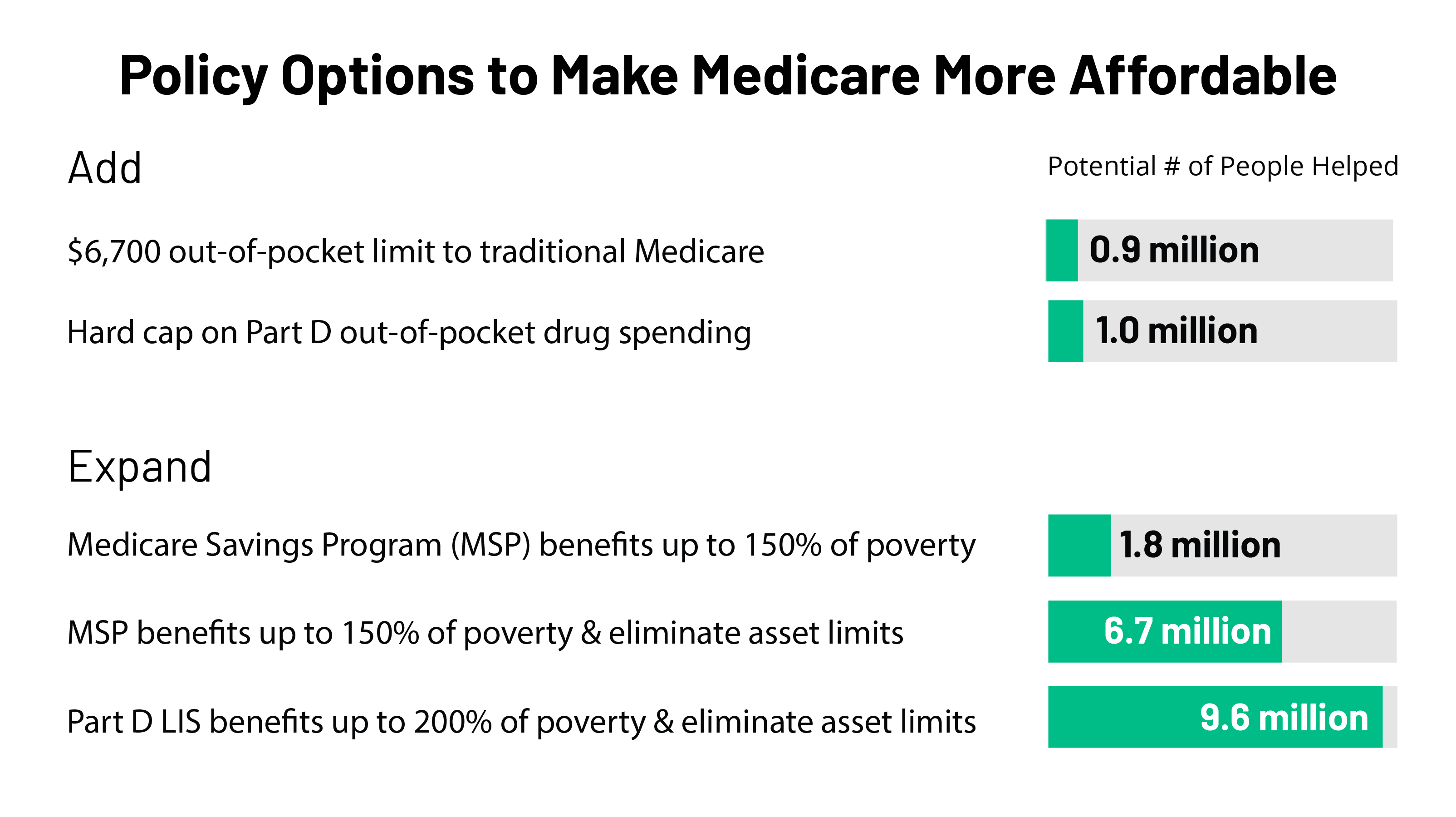

Medicare Financial Savings Programs (MSP) help people with restricted income and resources pay for some or all of their Medicare costs and also might additionally pay their Medicare deductibles and co-insurance. There are four various sorts of Medicare Cost savings Programs, this web page concentrates on the Certified Medicare Beneficiary (QMB) Program. That Certifies? If you have income from working, you may get approved for advantages also if your earnings is greater than the limits noted.

Aarp Plan G Fundamentals Explained

Exactly how To Use Where Do I Get These Solutions?

You can also see the Medicare website to look for Medicare service providers. If you have more questions concerning this program please see our Medicare/Medicaid Often Asked Inquiries or call our Member Contact Facility. Program Get in touch with: , 303-866-5402. The member's advantages are limited to settlement of the participant's Medicare Part B costs only. Service providers ought to inform the member that the solution is not a Medicaid-covered solution for a member that has only SLMB insurance coverage. When the EVS identifies a participant as having only Specified Reduced Earnings Medicare Recipient coverage (without additionally having Full Medicaid or Plan An insurance coverage), the company should contact Medicare to verify medical coverage.

When the EVS determines a participant as having Defined Reduced Earnings Medicare Beneficiary coverage and additionally Full Medicaid or Package A coverage (without waiver responsibility), Medicaid claims for services not covered by Medicare has to be submitted as normal Medicaid claims and also not as crossover claims. The participant's advantage is settlement of the member's Medicare Component B premium.

The participant's benefit is payment of the member's Medicare Component A premium. The EVS identifies this insurance coverage see this here as Certified Medicare Beneficiary - medicare plan g coverage.

Unknown Facts About Apply For Medicare

Yearly changes in the FPL mean that, also if you could not have gotten QMB in 2015, under the new FPL, you might have the ability to certify this year. To get the QMB program, you will require to contact your regional state Medicaid office. For more help, you may wish to call your neighborhood State Medical insurance Support Program (SHIP) - aarp plan g.

SPAPs are state-funded programs that provide low-income and clinically needy senior citizens as well as people with disabilities financial aid for prescription medications. medicare part d plans without donut hole. We have SPAP information online below (note that the SPAP details undergoes transform without notification): If you do not fulfill the low-income financial requirements to qualify for the QMB program, you still may have some of your Medicare prices covered by among the various other Medicare Cost Savings Programs.

Example of person asking for Premium-Part An and also Part B registration throughout a registration duration: Ms. Adler lives in Pennsylvania (a Part A Buy-In State) as well as does not have Medicare. She contacts her local FO in January 2018 because she desires Medicare insurance coverage yet can not manage the costs.

Adler might submit an application for "conditional registration" in Premium-Part A. Due to the fact that Ms. Adler resides in a Part A Buy-in State, the Part B as well as conditional Part A registration can be filed at any kind of time. The application is not refined as a General Enrollment Duration (GEP) application. The FO takes the application as well as refines it according to instructions in HI 00801.